It’s Never Too Early to Start Planning for Retirement: A Guide for Millennials (Pay Attention As Well, Gen Z)

A

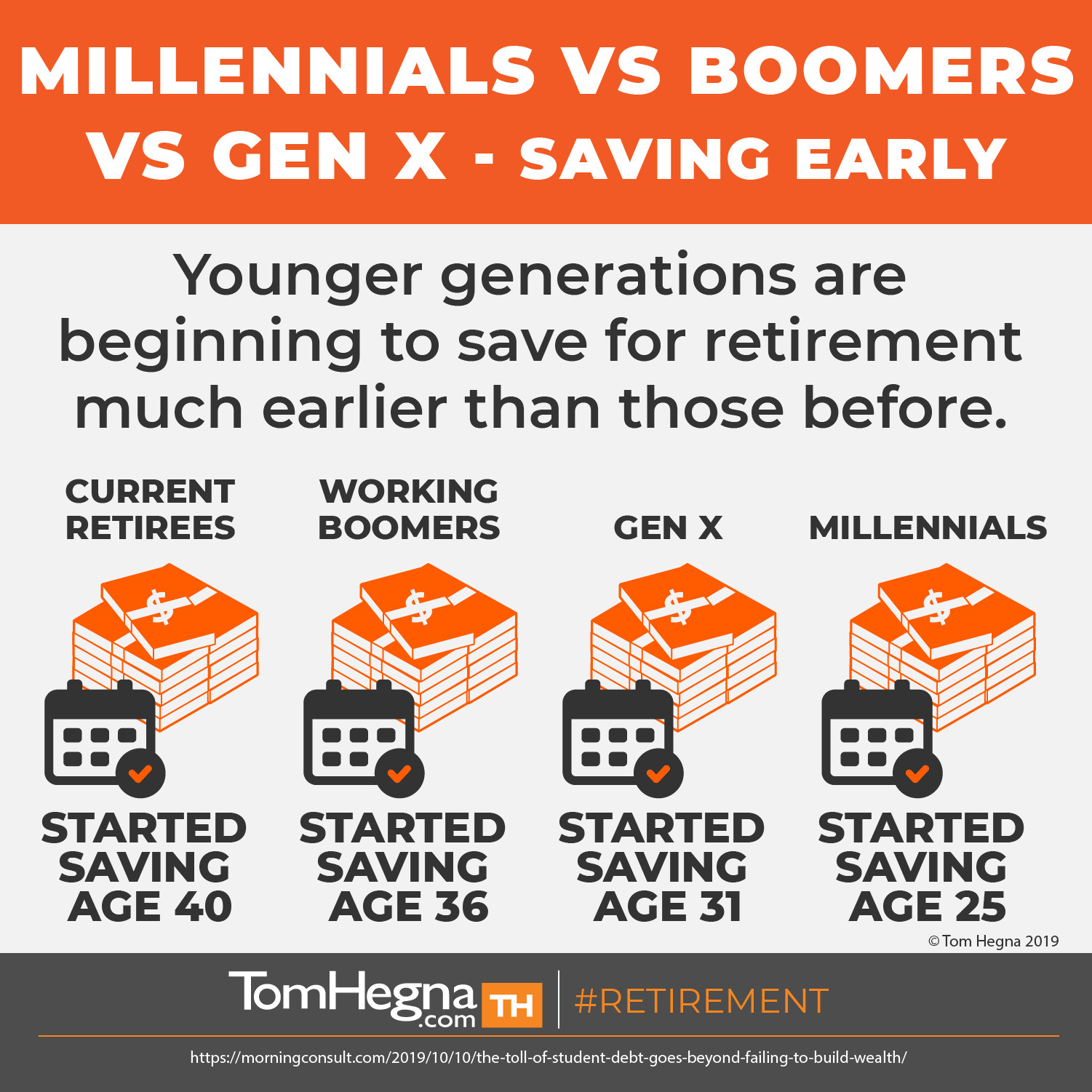

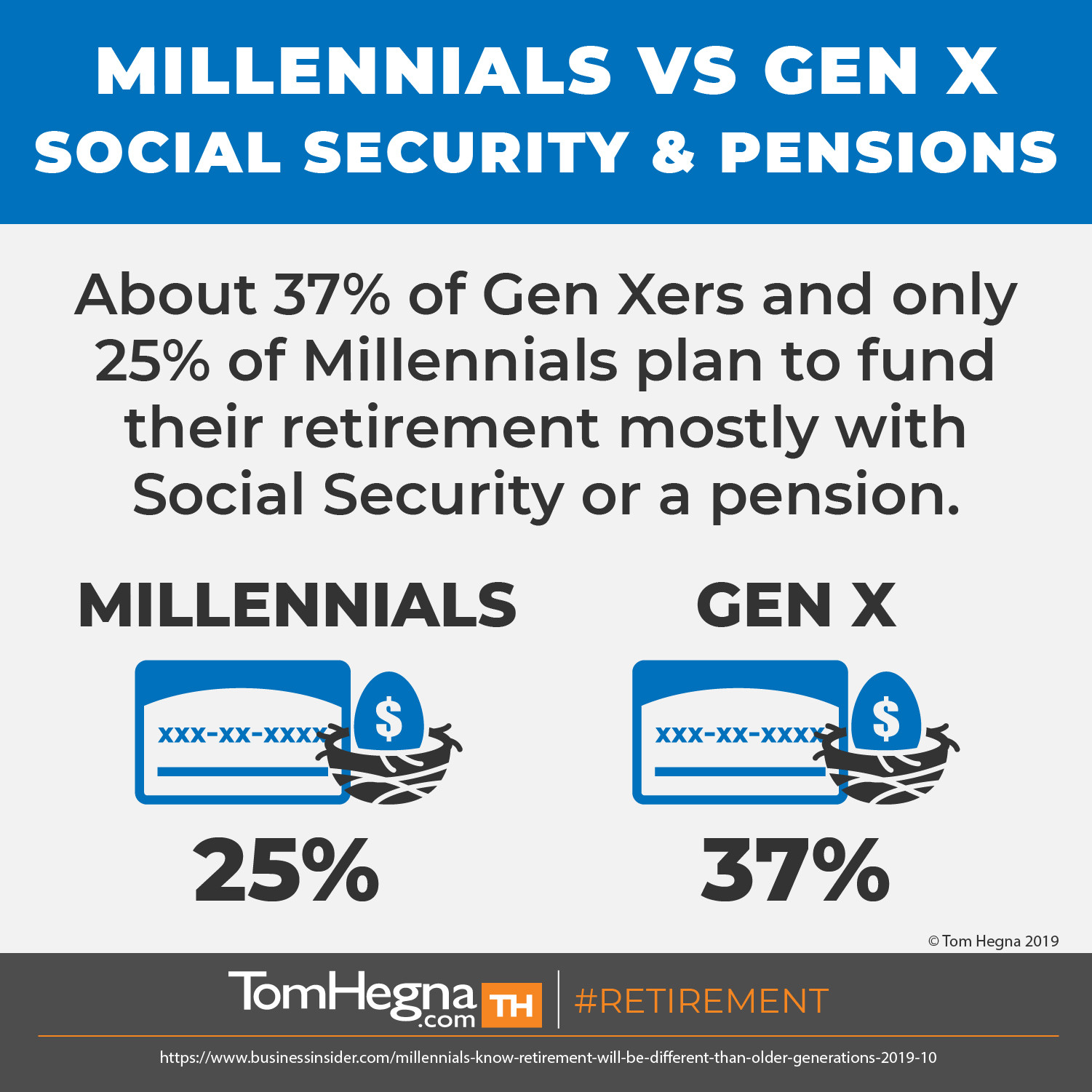

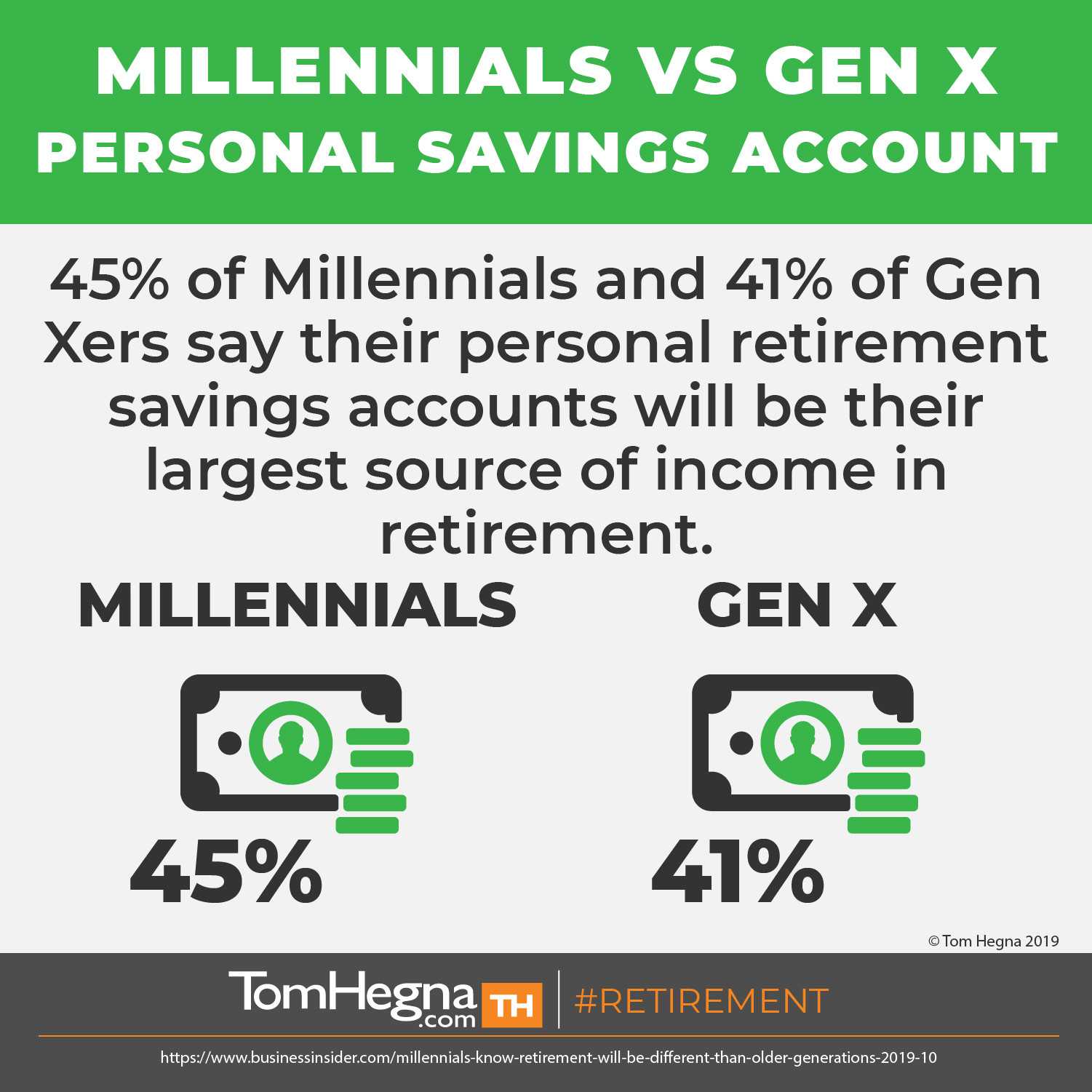

recent Wells Fargo survey conducted among 2,700 US workers and 1,000 retirees revealed that Millennials have begun saving for retirement from as early as age 25, while today’s retirees started at age 40. I have previously discussed how Baby Boomers and older generations are accustomed to ‘Work Until I Die’ plans, and how they are witnessing a paradigm shift in retirement planning. The majority of these retirees now live off Social Security incomes or pension plans. Because these forms of guaranteed lifetime income are disappearing, 45% of Millennials say that they intend to use personal retirement savings accounts as their main source of income when they retire. Additionally, many Millennials seem to be planning to retire early or before the age of 65. If your clients are among these Millennials, or if they are from any generation lacking a plan, I’ve got some quick tips to help you out.

1. Settle Your Debts

External factors like rising student debt and higher rent may work against Millennials’ desires to retire early, but it all boils down to strategy. One strategy is to focus on paying off higher-interest debts first and foremost. Baird’s Managing Director and CFP, Rick Wholey, stresses, “remember that in some cases, student loan interest is tax deductible."” Also, watch out for refinancing options that may offer a variable rate that could increase in the future.

2. Save Regularly

Daunting as it may seem, especially if you still have debts to pay off, beginning to save even small amounts or percentages of your income adds up over time. Make the most out of your company’s 401(k) plan with regular contributions, or at least 10% of your income. When your finances have stabilized enough for you to start saving in larger sums, consider getting a Roth IRA which helps you set aside $5,500 of your annual income. You will be able to access your contributions to it before the age of 59.5 with no penalties, as long as the value of your investments is the same as what was originally put in. Both the 401(k) and Roth IRA are tax-advantaged.

3. Create a Financial Plan or Consult a Financial Planner

Spending on a consultation with a financial planner may seem contradictory, but investing money in expert advice will yield high returns. However, a lot of Millennials have created their own strategy of living within their means, called Financial Independence Retire Early (FIRE). Followers of the FIRE movement try to invest as much as 75% of their yearly income and cut down on their daily expenses. But since everyone is unique in their income, spending habits, debts, and expenses, Millennials should have their own financial plans based on what they know is feasible.

4. Try Diversifying Your Investments

Avoid playing it safe with narrow portfolios. James Barnash, former president and chairman of the Financial Planning Association advises broadening the scope of your investments internationally. Small stocks also pave the way for greater returns. Consider real estate as an investment as well, as it’s a long-term opportunity that makes sense over time.

5. Consider Earning a Passive Income on the Side

Like we’ve said, real estate is a wise investment. For millennials who have considered purchasing their own homes, it may be better not to rush into anything and to consider becoming a landlord or renting spaces out first. This is an alternative source of income on the side to supplement your current job. It could help you save for retirement, and even be continued as a source of passive income once you've already retired.

Written by Aliiah Cathleen

Exclusive for TomHegna.com

I want to thank Aliiah Cathleen for this contribution to my blog and suggest you share it. If your clients are Millennials, remind them that they can buy deferred income annuities NOW that kick in during their retirement to provide guaranteed income for the rest of their lives!

See you after step one,

Tom Hegna