How Retirement Planning is Changing

I

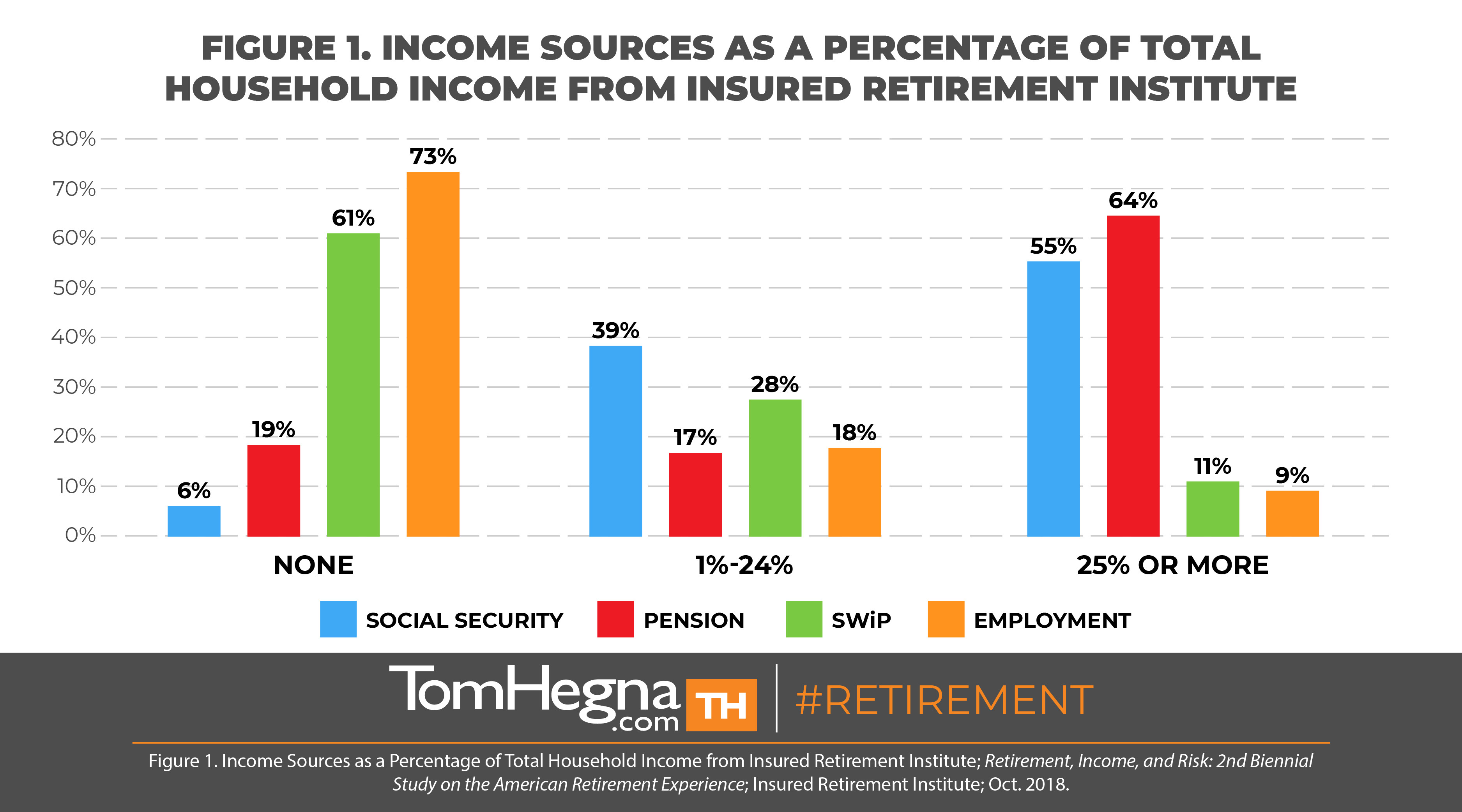

f you’re at all familiar with the first chapter of Paychecks and Playchecks: Retirement Solutions for Life, you know we are experiencing a paradigm shift in retirement planning. The traditional retirement historically consisted of three basically equal components—Social Security, a company pension, and personal savings. In 2016, the Insured Retirement Institute (IRI) began its research series on Americans age 65 to 85, who have been retired between five and 15 years and had at least $100,000 in investable assets when they retired. In October of 2018 their continued research reported, “...81 percent [of current retirees] receive at least some income from a pension, [and] 64 percent depend on a pension for at least 25 percent of their income…” Whether your clients are one of the lucky ones to receive a pension or they're a Boomer with lackluster savings, I’ll show you why guaranteed lifetime income is still the key to their optimal retirement. Let me start by laying out all the math and science behind this shift in retirement planning, and then I’ll share specific words and language you need to use to simplify all the facts for your clients.

Looking at the traditional, three-legged stool model of retirement planning, many of your clients probably think they will be able to simply rely more on Social Security or personal savings to make up for their shortcomings. The IRI found in April of 2018 that 95 percent of Boomers expect Social Security to be an important source of income; 50 percent said an employer pension would NOT be a source.

2013 research by Age Wave shows a similar shift in expected reliance on pensions, but reliance on Social Security remains relatively the same. Future retirees actually expect to use personal savings in place of a pension, yet according to a 2018 study by the Stanford Center on Longevity, “One-third of boomers had saved nothing in retirement accounts (in either workplace plans or IRAs) in 2014.” With Social Security expected to undergo some sort of reform within the next few presidential terms, how are you going to optimize your clients’ retirement plans? I’ll tell you, there is only one way—with guaranteed lifetime income that only an annuity can provide..

Now, all that research is well and good (the optimal retirement plan is backed by math and science after all), but you need to simplify it for your clients. You need to use specific language and powerful words to make a lifetime income annuity easy to understand. Let me put myself in your shoes for a moment and pretend to be your retirement planner. I’ll recommend a lifetime income annuity so that you can have a great retirement, and the first thing you will probably ask is, “Tom, what IS a lifetime income annuity?” Here are the words I use: It’s a guaranteed paycheck for life. That’s all it is: a guaranteed paycheck for life. To make it even easier to understand, let me remind you that you already have a lifetime income annuity—your Social Security check. Remember, Social Security is simply a guaranteed paycheck for life. If you have a pension, that is also a guaranteed paycheck for life. You see, Social Security and pensions are examples of lifetime income annuities, so if they are the weaker parts of your clients’ retirement plan, replace them with products that do the same thing! Think about it, they understand Social Security and pensions, so make it easy for them to understand annuities.

Every once in a while you will come across someone who says, “I don’t need another guaranteed paycheck, I worked for Boeing for 37 years. I already have a pension—I’ve got that covered.” Just smile and say, “Okay, you have the paycheck. But do you know what you need now? You need a guaranteed PLAYcheck!” Explain it like this: On what day of the week do you spend the most money right now? What day do you go golfing, go to Home Depot, go to the spa, or go shopping? For most of us, that day would be Saturday—and remember, when you retire, every single day is Saturday. Many Boomers are not going to need less money once they retire; they are in fact going to need more money. So I would say retirees are going to need more guaranteed lifetime income or else their retirement will be suboptimal—it will be less than it could have, would have, or should have been. Give Paychecks and Playchecks another read today for more, simplified ways of explaining the complex financial products your clients need to know about.

Thanks for reading,

-Tom Hegna