The Inflation Virus

nflation risk is something that can severely erode the purchasing power of your retirement plan. That's why your clients don't need only retirement income but INCREASING retirement income. There are a few ways to accomplish this while protecting your clients' assets from inflation, but first let me show you how inflation actually works.

Contrary to what many think, simply printing money doesn't cause inflation. If Jerome Powell, the new Federal Reserve chairman, printed $5 trillion and buried it in his backyard, it wouldn't make its way into the economy-- it therefore wouldn't cause inflation. Combining the printing of money with the velocity of money is what creates inflation. The velocity of money is the measurement of how fast money turns over in the economy based on the amount of economic activity, This can make inflation extremely hard to predict, so how can you protect your client's purchasing power.

For every dollar that is printed and makes its way into the economy, every existing dollar drops in value, so you need a plan that provides clients with increasing income to keep up. Look at the whole retirement planning process. During the accumulation phase, people are typically more risk-tolerant (especially since losses during the five years immediately before and after retirement can devastate any plan). Your clients can self-insure by boosting their retirement savings while still working by maximizing their IRA contributions. If their employer matches, it would be foolish to pass up that free money. Working longer can also help maximize Social Security benefits, and many might need to maximize their catch-up contributions. These strategies work for any clients and it’s up to you to sell them more guaranteed lifetime income for the distribution phase. Once you’ve done all that, it’s time to create INCREASING income in addition.

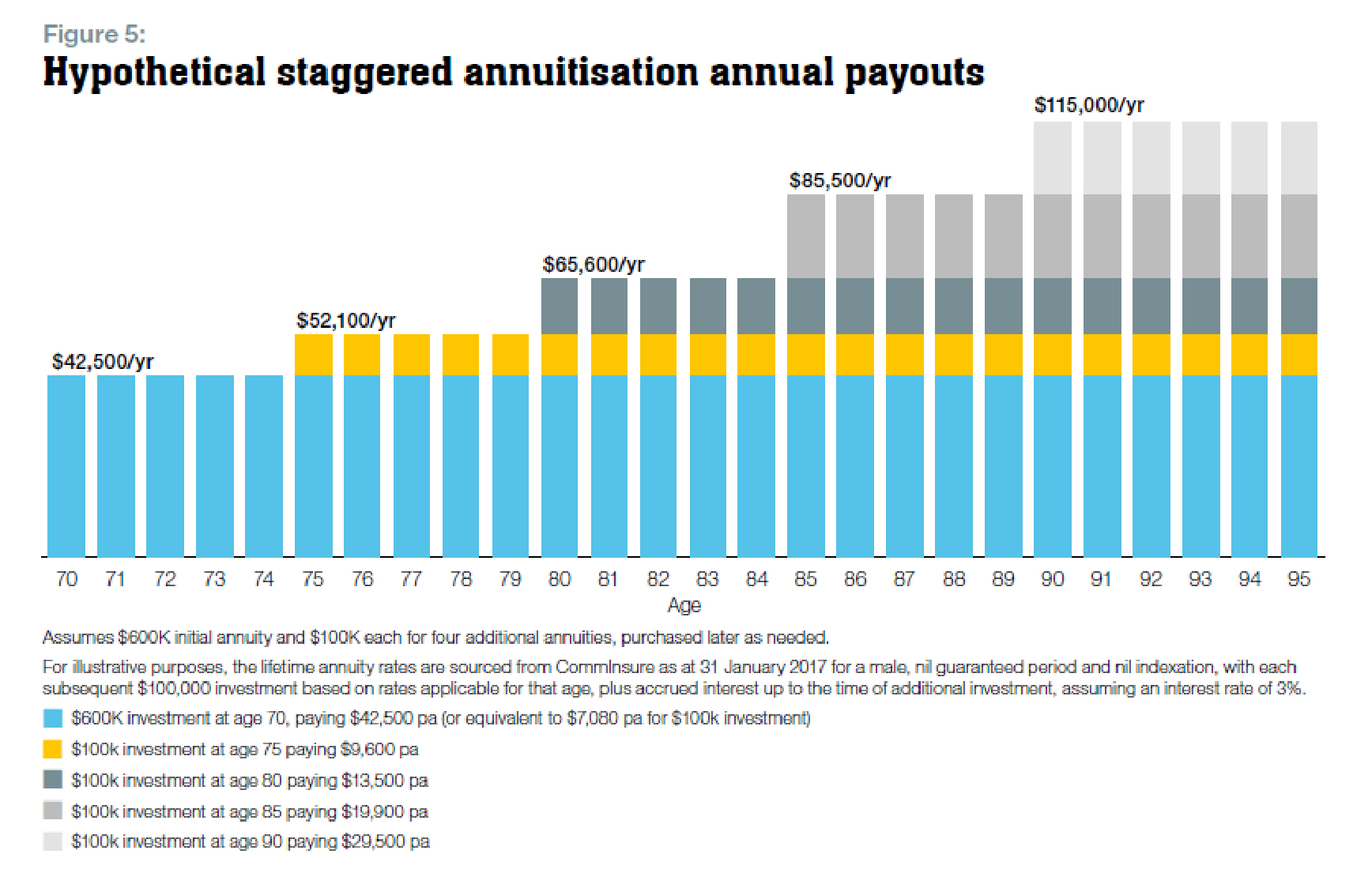

The distribution phase is when your clients will be calling you about their annuity, and it’s your chance to sell them more. You see, laddering several separate annuities tackles two risks. For one, it ensures your clients never outlive their money, but this also protects them from inflation risk. Dr. David Babbel has conducted research on this for years, and he released an article in 2017 called Retire Smarter: New Strategies Towards a Comfortable Retirement

Read over part three if you want to truly understand the power of staggered annuitisation, but basically the combination of mortality credits, paid principal, and interest keeps up with inflation because annuity pricing reflects the interest rates at the time of purchase.

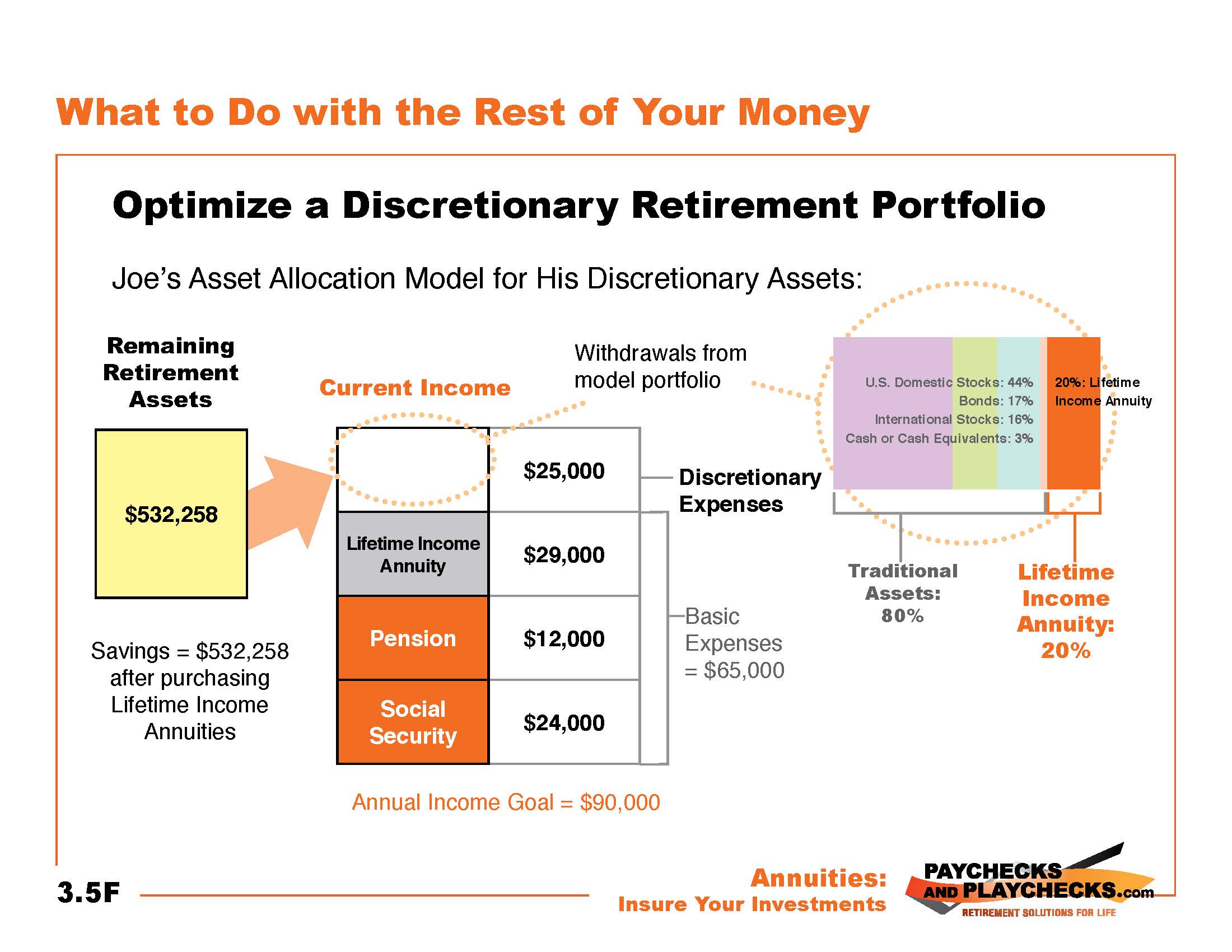

Now, there are also many inflation riders your clients could purchase for their annuities, and step two of the four simple steps in Paychecks and Playchecks is to optimize the rest of your portfolio to protect from inflation. It’s up to you to determine your clients’ concerns and evaluate their risk tolerance, but inflation is a risk that will almost certainly affect every retirement portfolio.

See You On the road

- Tom Hegna