Psychonomics: How to Help Your Clients Understand

hose of you who have followed me know I have literally based my career on math, science, and economics. I can prove mathematically to anyone that they should add an annuity to their retirement portfolio. In fact, anyone who doesn’t use an annuity in retirement is destined by math and science to have a sub-optimal portfolio. By removing some of the bonds from any diversified retirement portfolio, and replacing them with an income annuity, you will reduce the risk of that portfolio and increase the returns! However, there is another, perhaps even more powerful argument. One that is NOT based on math, science, or economics. One that is based on PSYCHONOMICS! Here’s what I mean.

You expected to receive something from your employer every two weeks for your entire working career, and you were glad every time it showed up. What was that called? A PAYCHECK! What did you do with most of that paycheck? You SPENT it paying for your house, your car, your vacations, and your stuff. Now let me ask you another question. When was the last time you raided your 401(k), your bank account, or your brokerage account? “Oh, we would never do THAT Tom! We have to protect it, save it, and grow it; we CAN’T touch it!” Okay, so you do that for 45 years. Do you honestly think that on your 65th birthday you are going to wake up and say, “Today I’m going to blow my 401(k)?” You can’t do it. You can’t spend your assets. No one can. In fact, most of your friends will go to their graves never touching their assets. See, you are programmed psychonomically for 45 years NOT to touch your assets.

You observe this every day. Your clients cannot spend their assets. We are taught two financial fundamentals our entire life: save more and more money for retirement, and spend our weekly paychecks. But what actually happens in retirement? We end up with this big pile of money, and we stop receiving paychecks! Hoarding money during our working years results in a lump sum of cash and several accumulated assets, but assets make people miserable in retirement. You see, some of the most miserable people in retirement are very wealthy, but they’re so worried about returns on their investments, the market, interest rates, and running out of money that they never achieve the happy factor of retirement. This happiness isn’t just backed by math, science, and economics, but it also depends on psychonomics! Think about it, retirees are faced with the psychological dilemma of, “How do I spend this huge lump sum of cash?” Here’s how you can answer this question for clients, and I bet they’ll be asking about your products after you do

People are familiar with spending or saving their paychecks. Explain this to them—during their working years, systems like contribution plans make decisions FOR them through things like their 401(k). When they retire though, they won’t have those systems protecting their big pile of money anymore. Since most people are familiar with receiving a monthly paycheck, wouldn’t it be more understandable and manageable to receive regular, monthly income? Tell your clients, retirement isn’t about assets. It also isn’t about spending too much or too little. Retirement is about spending your pile of money OPTIMALLY! This is why PhDs who have studied retirement insist that people take a portion of their assets to buy an income annuity that will give them guaranteed paychecks and playchecks for the rest of their lives! They can (and will) spend these checks and use them to actually enjoy their retirements! See, it is the spending of money that allows people to enjoy their retirements—not the hoarding of money.

The success or failure of this really depends on their answer to two simple questions.how much guaranteed lifetime income do they have? Remind clients that they need to create their own systems to protect them from spending away their accumulated money. Provide psychonomics they are familiar with. They need a paycheck; they need income; they need an annuity! The second question to ask clients is, have you taken the key retirement risks off the table? Paychecks and Playchecks discusses all Tom Hegna on Demand’s Holistic Planning provides solutions. But the number one risk you need to warn your clients about is longevity risk because it’s not only a risk but a risk multiplier! And guess what, guaranteed lifetime income like an annuity is the only way to completely remove this risk from the table.

Talk to your clients about psychonomics this week. You’ll be surprised to see how easy it is for them to understand that an annuity is like receiving a regular paycheck in retirement. And remember, retirement is now about income not assets.

See you after your next sale,

-Tom Hegna

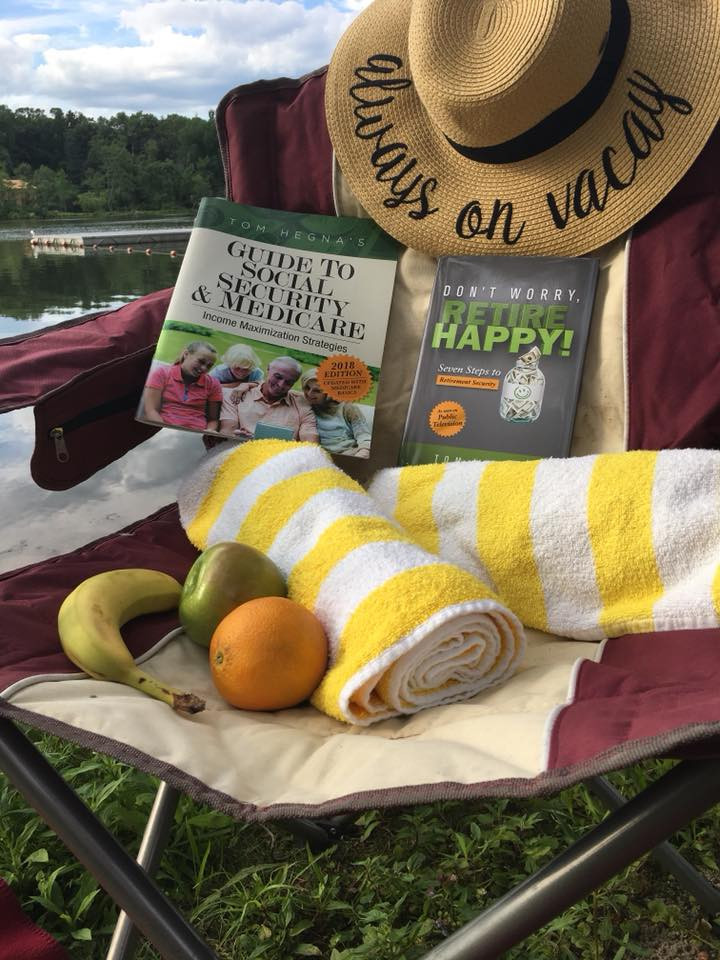

PS: Congratulations to Ken and Robin who submitted this photo for my Facebook contest. Looks like they know how to retire happy! I sent Ken a signed copy ofPaychecks and Playchecks in appreciation for his participation. Sign up for my newsletter and follow me on social media for more offers and contests like this!