Objections are Inevitable

E

ver have a client immediately object to your financial products when they walk through the door to an appointment? Objections are inevitable. You should expect them, but more importantly, be prepared for them by anticipating them. Objections show that the client is interested so you should welcome them. Here are some techniques you can use when encountering objections. First off, thank the prospect for the objection. Empathize with them with responses like, "I hear that often," or, "I used to say the exact same thing!" Then explain why the objection isn't the problem. Another technique, although it sounds counter-intuitive, is to just ignore the objection. Smile and say, "That's okay," and continue your presentation. The reason this works is that most initial objections are FALSE objections. A person sometimes throws out a common objection because he just doesn't know what to say. If you are constantly hearing the same objection in appointments, you need to include it in your presentation to handle it before it's brought up. Another great technique is to use third party references to handle the objection. I use the research of PhD's to prove my points, and many advisors use my books as their third party reference. Let me share some of the top objections I’ve encountered. Plus, I’ll tell you how to handle each one.

| Objection: | Here's what I say: |

|---|---|

| "Annuities are BAD!" | "Annuities are NOT bad. They do things no other product can!" |

Ken Fisher preaches annuities are bad like a broken record. Your prospects and clients associate annuities with that bad stigma. Ken Fisher picks on them because he wants clients to transfer their assets and financial control to a Ken Fisher account. I wrote about Mr. Fisher's LOVE for annuities before. But let me ask you this: is this in the best interest of the client? NO, math and science proves that some form of guaranteed lifetime income is the only way to hedge longevity risk . Stocks, bonds, and CD’s won’t do it. Look, not all annuities are bad, but, just like anything else, there is such a thing as a bad annuity. There are bad stocks, bonds, and CD’s. In fact, the indicators of bad products are all similar. Avoid these indicators to choose a good annuity, and debunk the, “Annuities are BAD” objection:

High surrender charges > 8%

Long surrender charges> 8 years

Forced annuitization of a deferred annuity

High commissions

| Objection: | Here's what I say: |

|---|---|

| "Fees and charges are too high!" | "Compared to what?" |

Compared to WHAT? Fees only matter in the absence of value. Yes, the fees of variable annuities are higher than ETF's or Mutual Funds, but they also have guarantees that the other products don't have. Retirement is all about making the most and losing the least after fees which is called "risk adjusted net return." Did you know that many annuity products do not even have fees? Some annuities have absolutely NO FEES because they are a SPREAD product. Single Premium Immediate Annuities and Deferred Income Annuities are examples of of spread products. Fixed Annuities and Fixed Index Annuities usually have surrender charges instead of fees. The point is to show clients the value of tax deferred growth and guaranteed lifetime income. Then they will be open to your other products like life insurance. Well, some stubborn baby-boomers may have objections about that too.

| Objection: | Here's what I say: |

|---|---|

| "I'm already covered for life insurance by my employer." | "Is it enough?" |

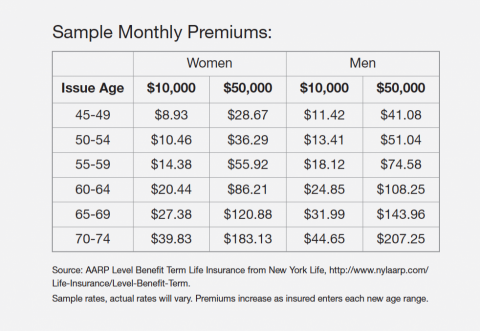

First off, employer provided life insurance is called, "Group SUPPLEMENTAL Life Insurance. It is supposed to supplement your own personal policy. These policies are also very small, and they will not provide enough. How much is enough? How much does your client need? I suggest for every $50,000 of income, a retiree needs $1,000,000 of life insurance coverage . Look at your salary. Does your employer’s policy cover enough? The shortfall needs to be covered with some form of life insurance or else you’re underinsured. Ask your clients what age they think they need life insurance. Show them what it costs at that age versus what it costs NOW.

There will be times when more insurance is needed, and there will be times when less is needed. What you need when raising kids is different from what you need when they’ve moved out and you’re ready to retire. Review major milestones of life to make sure the whole family is covered.

There will be times when more insurance is needed, and there will be times when less is needed. What you need when raising kids is different from what you need when they’ve moved out and you’re ready to retire. Review major milestones of life to make sure the whole family is covered.

| Objection: | Here's what I say: |

|---|---|

| "I only want TERM insurance" | "Look, here is the ultimate truth about life insurance..." |

The only policy that matters is the one that’s in force on the day that you die! Less than 2% of term insurance is in force on the day that you die. Term insurance isn’t a BAD policy; it just shouldn't be the ONLY policy. It should supplement or be in addition to other insurance. Maybe your client heard about buying term insurance and investing the difference. How many people who say this actually end up investing the difference though? I know people who SPEND the difference. I know people who LOSE the difference. Whole life insurance can actually provide protection for the whole family while also accumulating tax-free cash value with the right policy. Planning your presentation for objections like this gives you the option to educate prospects and clients about your products.

Objections are inevitable. Retirement is riddled with misunderstandings and stigmas, but don’t let talking heads mislead your clients. Educate them. I have a tool to help. Communication is key. Words, language, and stories will be the difference, not the rates. Act in the best interest of clients; uphold the fiduciary standard. It’s in clients’ best interest to take longevity risk off the table, and math and science proves that some form of guaranteed lifetime income is the only way to achieve this.

What are the motives of an advisor who doesn’t include one?

Is that advisor following fiduciary standards?

Has a client ever brought a Ken Fisher article into an appointment?

Ken Fisher’s “I hate annuities” warpath aims to poach your clients and hoard their finances. Don’t worry though, I’m writing a letter to the SEC, and I’ll share it with you in my next newsletter.

-Tom Hegna