How to Plan for Taxation Risk

resident Donald Trump has proposed a new tax plan. The actual changes to the tax law are uncertain since Congress has been having difficulty passing anything lately. However, tax planning is often overlooked as part of your retirement plan. Most people are concerned about the markets or outliving their money and rightfully so. While those are two important risks to prepare for, taxation risk falls into its own category. Simply put, you need to plan.

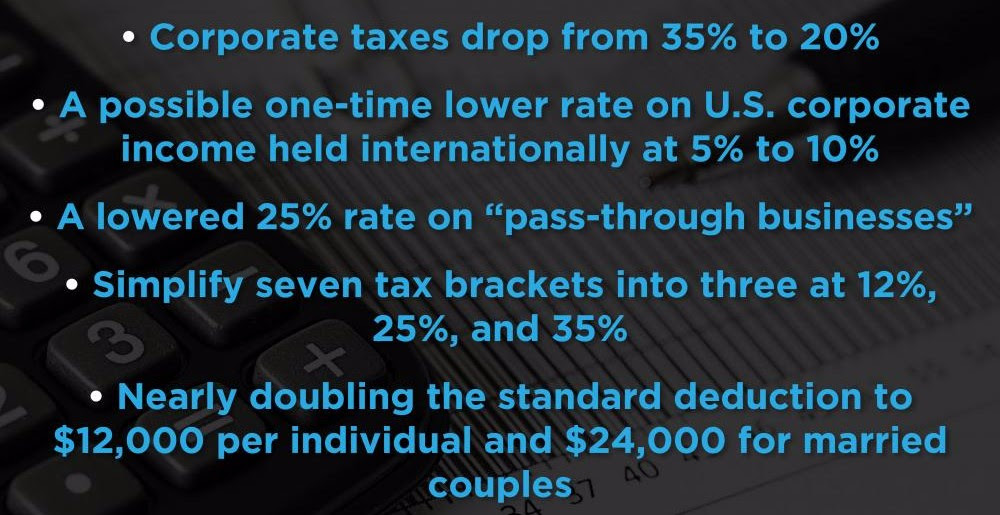

Whether taxes go up, down, or sideways, you need to be prepared. The current U.S. and world economies have shown signs of volatility. Change is inevitable. Take a brief look at Trump’s tax overhaul:

What does this mean for you and your clients? Well look, all of the above sections of the reform bill could affect your retirement in different ways. The ambitious bill is an undertaking that we have not seen since the Reagan Tax Reform during the 80’s. Even with the lowering of some tax rates, we aren’t likely to see taxes go any lower for years to come. With nearly $21 trillion in debt and liabilities, the U.S. Government has a lot of debt to pay down. While I personally hope we get tax reform, I’d recommend planning for an INCREASE in tax liabilities eventually.

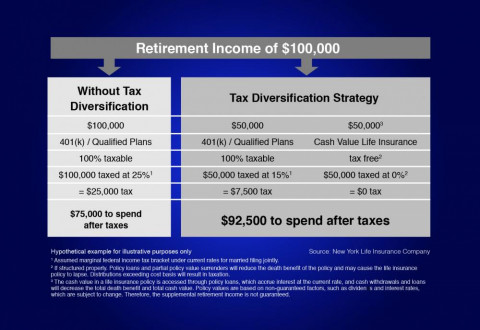

How exactly can you diversify your tax plan? Your plan needs to be flexible so you’re prepared for the good and the bad scenarios. Here’s an example from Paychecks and Playchecks:

It’s clear in this example that by moving a portion of your money into a Roth IRA or a cash value life insurance policy, you can potentially lower your taxes AND have more money to spend! In any case, it always makes sense to diversify. If taxes do go down, it would be a GREAT opportunity to convert your IRA to a Roth IRA, so that when taxes go back up you will have the ability to make tax-free withdrawals in retirement!

Trump’s tax proposal could have a positive effect or a negative effect on your retirement savings. You and your clients need to prepare for both. Our government has spent way too much money, and it needs to begin deleveraging. In other words, taxes are likely to go up beyond this tax reform. Having tax-free options like Roth IRA's and Cash Value Life Insurance can diversify your tax plan. Every single day you wait to plan your retirement is a day lost. Get started now!

See you on the road,

-Tom Hegna